Maximizing ROI on Small to Mid-Size Multifamily Properties: Expert Tips and Strategies

Maximizing ROI on Small to Mid-Size Multifamily Properties: Expert Tips and Strategies

Investing in small to mid-size multifamily properties can be a lucrative venture, but maximizing your return on investment (ROI) requires strategic planning and effective management. Whether you are a seasoned investor or just starting, these expert tips and strategies will help you enhance your property's performance and achieve the highest possible returns.

1. Efficient Property Management

Effective property management is crucial for maximizing ROI. Consider the following tips:

-Hire a Professional Property Manager: If managing the property yourself is overwhelming, hire a professional property manager. They can handle day-to-day operations, tenant relations, and maintenance issues efficiently.

- Implement Technology: Use property management software to streamline operations, track expenses, and manage tenant communications.

- Routine Inspections: Conduct regular property inspections to identify and address maintenance issues promptly, preventing costly repairs down the line.

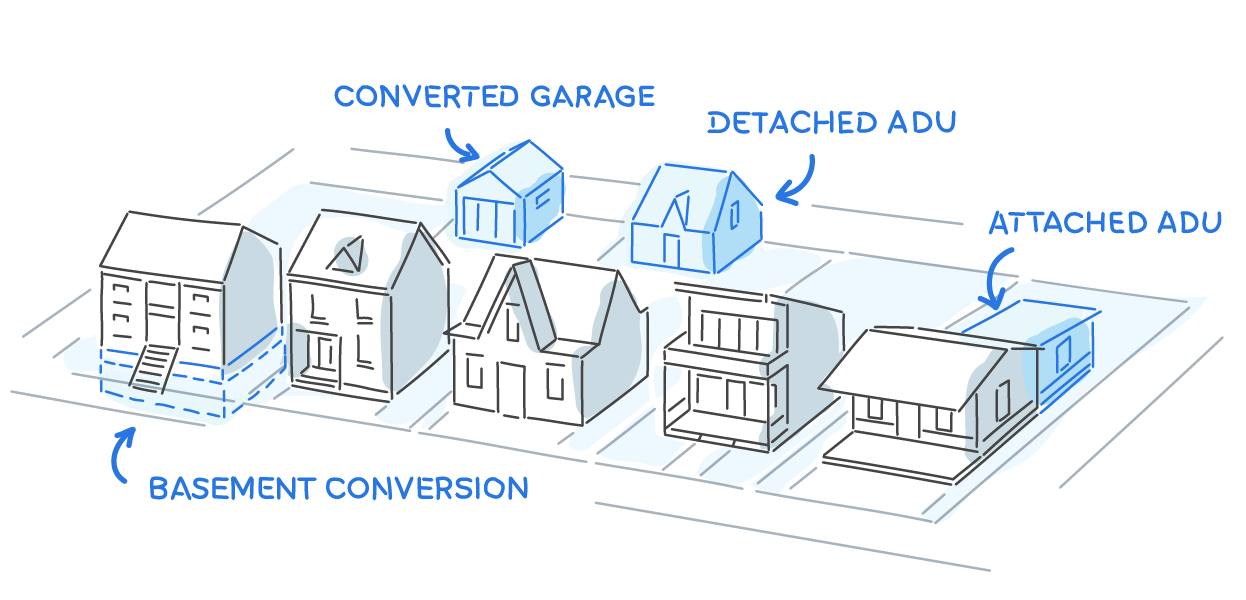

2. Value-Add Renovations and Upgrades

Enhancing the property's appeal and functionality can significantly increase its value and rental income. Consider these value-add strategies:

- Upgrade Units: Modernize kitchens and bathrooms with new fixtures, appliances, and finishes. Consider adding amenities like in-unit laundry or smart home features.

- Enhance Curb Appeal: Invest in landscaping, exterior paint, and common area improvements to attract higher-paying tenants.

- Energy Efficiency: Upgrade to energy-efficient windows, HVAC systems, and lighting to reduce operating costs and appeal to eco-conscious tenants.

3. Optimizing Tenant Retention

High tenant turnover can erode your ROI due to lost rent and turnover costs. Implement strategies to keep tenants satisfied and reduce vacancy rates:

-Build Strong Relationships: Foster positive relationships with tenants by being responsive to their needs and maintaining open communication.

-Lease Renewals: Offer incentives for lease renewals, such as minor upgrades or rental discounts.

-Community Building: Create a sense of community by organizing events and improving common areas, making tenants feel more connected and inclined to stay.

4. Cost-Saving Maintenance Tips

Keeping operating costs low while maintaining the property’s quality is essential for maximizing ROI. Here are some cost-saving maintenance tips:

-Preventive Maintenance: Implement a preventive maintenance schedule to address issues before they become major problems.

-Bulk Purchasing: Buy maintenance supplies in bulk to take advantage of discounts.

-In-House Repairs: Train staff to handle minor repairs and maintenance tasks to save on contractor fees.

5. Effective Marketing and Leasing Strategies

Attracting and retaining quality tenants is key to maximizing rental income. Employ these marketing and leasing strategies:

-Targeted Marketing: Use digital marketing tools to target potential tenants based on demographics and preferences.

-Professional Photography: Invest in professional photos and virtual tours to showcase your property online.

-Flexible Lease Terms: Offer flexible lease terms to attract a wider range of tenants, including short-term leases for corporate clients.

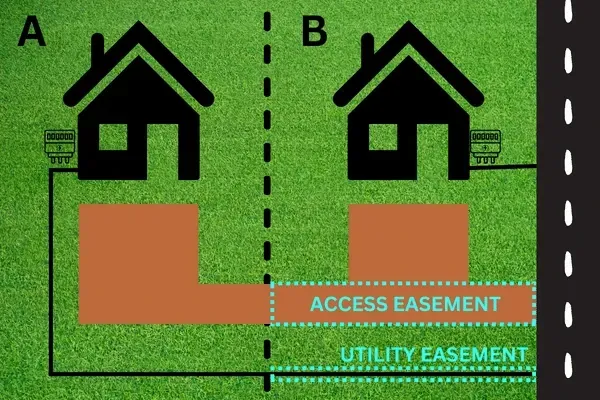

6. Leverage Financial Strategies

Optimize your investment by leveraging smart financial strategies:

-Refinancing: Take advantage of lower interest rates to refinance and reduce mortgage payments, freeing up cash flow for other investments.

-Tax Benefits: Utilize available tax benefits, such as depreciation, to lower your taxable income.

-Equity Growth: Regularly assess the property's value and consider using equity growth to finance additional investments.

Case Studies and Success Stories

To illustrate the effectiveness of these strategies, here are a few success stories from small to mid-size multifamily property investors:

-Case Study 1: An investor increased ROI by 25% after upgrading units with modern amenities and implementing a robust tenant retention program.

-Case Study 2: By hiring a professional property manager and leveraging technology, another investor reduced vacancy rates by 15% and significantly improved tenant satisfaction.

Conclusion

Maximizing ROI on small to mid-size multifamily properties requires a combination of effective property management, strategic upgrades, tenant retention efforts, cost-saving maintenance, and savvy financial strategies. By implementing these expert tips, you can enhance your property's performance and achieve higher returns on your investment.

For more personalized advice and professional assistance, contact Sakeenah Redmond Real Estate. We’re here to help you navigate the multifamily property market and maximize your investment potential.